Need Money Today? Don't Let Bad Credit Hold You Back! Your Guide to Fast, Safe Bad Credit Loans

In times of financial distress, securing funds quickly can be a lifeline. Whether it’s covering unexpected medical expenses, urgent home repairs, or last-minute bills, having quick access to funds is crucial. However, individuals with poor credit history often struggle to secure traditional bank loans. Fortunately, bad credit loans in Canada offer a safe and accessible financial solution for those in need. These loans provide fast approval, no hidden fees, and flexible repayment options, making them an excellent alternative for people with bad credit.

What Are Bad Credit Loans?

A bad credit loan is a type of personal loan designed specifically for individuals with low or poor credit scores. Unlike conventional bank loans, these loans do not rely solely on credit history to determine eligibility. Instead, lenders consider other factors, such as income stability, employment status, or available collateral.

Types of Bad Credit Loans in Canada:

- Unsecured Personal Loans – No collateral required; based on income and affordability.

- Secured Loans – Require collateral such as a vehicle or home but offer lower interest rates.

- Instant Loans for People with Bad Credit – Fast processing and same-day funding.

- No Credit Check Loans – Approval based on income, not credit score.

These loans cater to a wide range of financial needs, making them ideal for individuals facing urgent cash requirements.

Common Concerns About Bad Credit Loans and How to Overcome Them

Many individuals hesitate to apply for bad credit loans due to concerns about high interest rates, legitimacy, and repayment flexibility. However, Canada has strict financial regulations that protect borrowers from unfair lending practices.

How to Ensure a Safe Borrowing Experience?

Choose Reputable Lenders – Look for licensed financial institutions like:

- Magical Credit – Offers flexible repayment terms and transparent conditions.

- Money Mart – Specializes in personal loans for poor credit borrowers.

- BHM Financial – Provides secured and unsecured loans for various financial situations.

Verify Loan Terms – Avoid hidden fees by reviewing all loan documents before signing.

Flexible Repayment Options – Some lenders offer tailored repayment plans to prevent borrowers from falling into financial hardship.

Regulated Lending Practices – The Financial Consumer Agency of Canada (FCAC) ensures that lenders follow ethical practices and disclose all fees upfront (FCAC Guide).

By choosing a trusted lender and reviewing loan terms carefully, borrowers can confidently access emergency funds without unnecessary risks.

Benefits of Bad Credit Loans

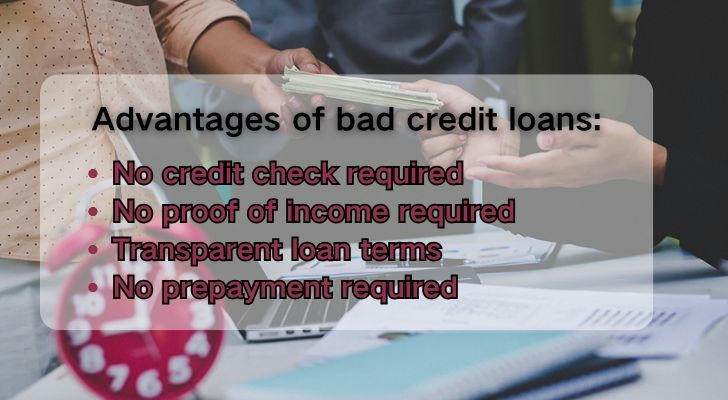

Bad credit loans provide numerous advantages for those struggling to secure financing through traditional banks. Here are some of the key benefits:

No Credit Check Required – Many lenders offer loans without checking credit history, making them ideal for blacklist loan applicants.

Fast Approval & Instant Funding – Some lenders provide instant approval with same-day funding, perfect for those searching for I need money urgently today solutions.

No Income Proof Needed – Some lenders do not require proof of stable income, making these loans accessible to freelancers, self-employed individuals, or gig workers.

Transparent Loan Terms – Reputable lenders, such as Money Mart, clearly outline interest rates, repayment plans, and fees, ensuring no hidden surprises.

Flexible Repayment Options – Borrowers can choose from multiple repayment schedules, helping them manage payments more effectively.

No Upfront Payments – Many bad credit loan providers do not require prepayments, allowing borrowers to access funds without additional costs.

Options for Different Age Groups:

- Young Adults (18-30) – Great for covering student loans, rent, or unexpected expenses.

- Middle-Aged Individuals (30-50) – Ideal for home renovations, medical bills, or emergency expenses.

- Seniors (50+) – Certain lenders offer low-interest loans tailored for retirees and pensioners.

For example, BHM Financial offers loan plans suitable for all age groups, ensuring financial stability for everyone.

How to Apply for a Bad Credit Loan in Canada?

Applying for a bad credit personal loan is a simple and straightforward process. Follow these steps to secure funding quickly:

Step 1: Choose a Reputable Lender

- Visit a trusted online lender, such as Magical Credit or Money Mart.

- Compare interest rates, repayment terms, and loan amounts.

Step 2: Fill Out an Online Application

- Provide basic personal details, including name, address, and employment status.

- Select the loan amount and repayment period that best suits your needs.

Step 3: Loan Approval & Fund Transfer

- Many lenders offer instant loan approvals (Prêt Instantané par Carte).

- If approved, funds can be deposited within 24 hours.

Step 4: Repay the Loan Responsibly

- Follow your repayment schedule to avoid late fees and improve your credit score.

- Some lenders offer early repayment options without penalties.

Secure Your Emergency Funds with Confidence

Bad credit should not prevent anyone from accessing reliable financial support. With Canada’s regulated lending industry, borrowers can safely obtain emergency funds without hidden fees or unfair terms.